Indianapolis Colts Franchise Value

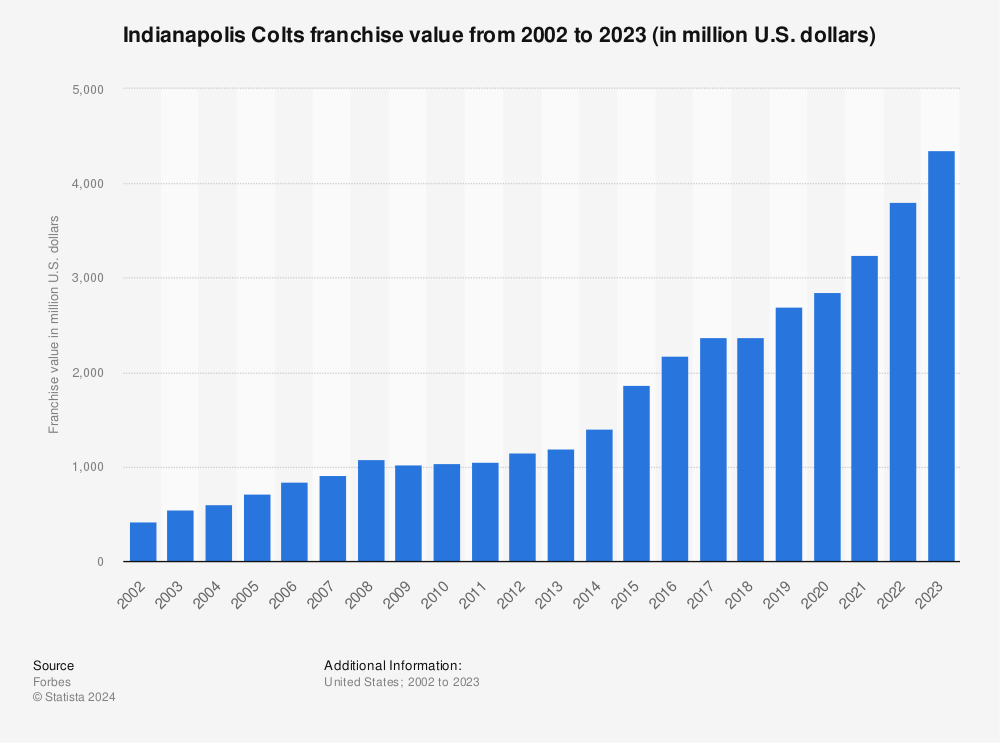

The modern NFL is a billion-dollar business fueled by diverse income sources. The Colts boast an estimated $4.35 billion franchise value per Forbes. But how does the team make its money and what exactly is the Indianapolis Colts franchise value?

Indianapolis Colts Team Value: $4.8 Billion

- Owner: Jim Irsay

- Championships: 4

- Year Purchased: 1972

- Price Paid: $14 Million

- Revenue: $545 Million

- Operating Income: $101 Million

- Player Expenses: $289 Million

- Gate Receipts: $94 Million

- Revenue Per Fan: $68

MORE: VIEW THE FUL LIST OF NFL TEAM VALUATIONS

How Much Are the Indianapolis Colts Worth?

$4.8 billion – Forbes assigned this updated figure to the Indianapolis Colts’ franchise value in 2024. While still behind corporate titans like the $10 billion Dallas Cowboys, the Colts have seen steady net worth growth, up over 15% in just three years.

According to CNBC,

the Colts’ are worth a much more generous valuation of $5.8 billion.

Revenue: $564M

EBITDA: $47M

Debt as percentage of value: 9%

How Much Money Did the Colts Make in 2023?

The franchise pulled in an impressive $545 million in total 2023 revenue, Forbes data shows. A chunk came from the NFL’s $10 billion TV deal split amongst teams.

Ticket Sales: $122 million

Sponsorships: $102 million

Merchandise: $57 million

RELATED: 6 REVENUE STREAMS EXPLAINING HOW SPORTS TEAMS MAKE MONEY

How Do the Colts Make Money?

Those hefty numbers illustrate the economic force behind NFL teams like the Colts. Selling out home games is step one – real profits come from corporate sponsorships blanketing stadiums and merchandise sold globally to diehard fans.

TV contracts are the biggest cash cow, with networks paying premium prices for broadcast rights. And bidding wars for coveted NFL content keep inflating costs.

Who Owns the Indianapolis Colts?

Reaping these lucrative rewards is businessman Jim Irsay, who took over as Colts owner in 1997 after his father Robert’s passing. The Irsay family built wealth from heating and ventilation companies before purchasing the Baltimore Colts for a then-record $195 million in 1972.

25 years and a controversial midnight move later, the rebranded Indianapolis Colts are Irsay’s prized asset. His $3.6 billion+ net worth stems largely from the team’s skyrocketing value and diverse business interests.

Lucas Oil Stadium

Opened in 2018 as a replacement to RCA Dome, Lucas Oil Stadium is a multi=purpose retractable stadium constructed to also serve as an expansion of the Indiana Convention Center. Uniquely, the stadium allows the Colts’ to play both indoors and outdoors with a retractable roof and large retractable window on one end.

Annual Rent: $250,000

Annual City Reimbursement: $3.5 Million

(The city of Indianapolis gets control of Lucas Oil Stadium and revenue for non-NFL events in exchange for the reimbursement)

Typical to almost all NFL teams, stadium naming rights belong to a large corporation or brand serving as one of many revenue sources for franchises. From 1984-2007, Colt’s home stadium awarded naming rights to RCA with the shift to Lucas Oil coming in 2006 along with the construction of the new stadium. Lucas Oil is an American manufacturer and distributor of automotive, additives, oils, and lubricants headquartered in Indianapolis.

The stadium also has unique sponsorship deals in place for each gate entrance which is an interesting way of maximizing the monetization efforts for the team.

- North Gate: Lucas Oil

- West Gate: Huntington Bank

- South Gate: Caesars Entertainment

- East Gate: Verizon Wireless

Caesars Entertainment, as official partners with the Indianapolis Colts, also has a sports book lounge in Lucas Oil Stadium.

Stadium Financing and Operations

Lucas Oil Stadium opened with a total construction cost of $720 million, funded through a partnership between the State of Indiana, City of Indianapolis, and the Indianapolis Colts. The Colts contributed $100 million to the project, while public funding came from various tax increases in Marion County, including levies on food and beverage sales, auto rentals, lodging, and admission fees.

The financing plan extended to eight neighboring counties, which implemented a 1% food and beverage tax. These counties retained 50% of their collected revenue, with the remainder supporting the stadium project. Morgan County initially declined but later enacted its own 1% tax, keeping all proceeds within the county.

Operational Challenges

The Capital Improvement Board (CIB), responsible for stadium operations, identified significant financial challenges shortly after opening. Operating costs exceeded those of the previous RCA Dome by $10 million annually. Initial attempts to address this shortfall through statewide sales tax increases faced resistance from legislators outside Indianapolis.

The solution ultimately involved:

- Targeted tax increases in Indianapolis-Marion County

- CIB budget reductions of $10 million

- Staff reductions

Despite these measures, the stadium faced a $20 million operating deficit in 2009. Annual operating expenses of $27.7 million substantially exceeded the CIB’s expected event revenue of $7.7 million.

Revenue Sharing and Public Response

The Colts’ stadium lease terms and revenue-sharing agreement have drawn public scrutiny, particularly regarding the team’s limited responsibility for operational shortfalls. The franchise addressed these concerns in a public statement to fans in September 2009.

Infrastructure Issues

The stadium has experienced two notable structural incidents:

- 2013: A rail collapse above the visiting team tunnel injured two spectators

- 2015: A falling roof bolt injured three fans during a preseason game, leading to temporary closure of the retractable roof pending safety investigations

Colts Looking Forward

Love or loathe them, the Indianapolis Colts are an absolute force on and off the field. With a $4.8 billion franchise value, ownership prints money win or lose. Lucrative TV deals, corporate partners, and merchandise fire those revenue engines.

So while we marvel at Jonathan Taylor’s heroics, remember the real heavyweights: the business titans who molded this NFL team into a financial empire. The pursuit of Super Bowl glory is matched only by an even-greater chase for maximum profitability.